All-in-One Platform

for (Re)Insurance

Operations

Simplify underwriting, claims, finance, and reporting

with automation and AI.

Less manual work, more transparency, all in one place.

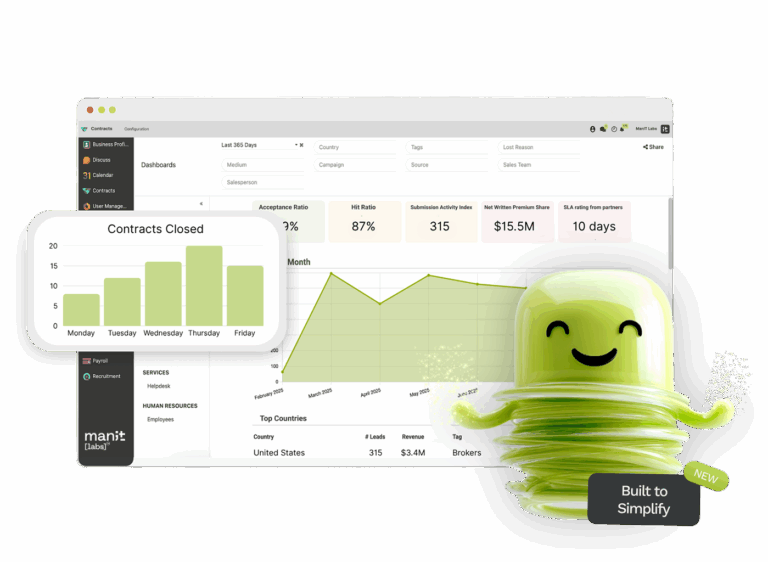

Proof in the Numbers

-

X2

Manit Labs doubles revenue with automation

and visibility -

10 days

Manit Labs launches in 10 days, delivering value

from day one. -

60%

Manit Labs boosts efficiency by 60%.

Less manual work, faster growth.

Built for real results

-

Built by (Re)Insurance

ExpertsCreated by professionals with deep industry and technology expertise. Built for the real needs of insurers, reinsurers, MGAs, and brokers.

-

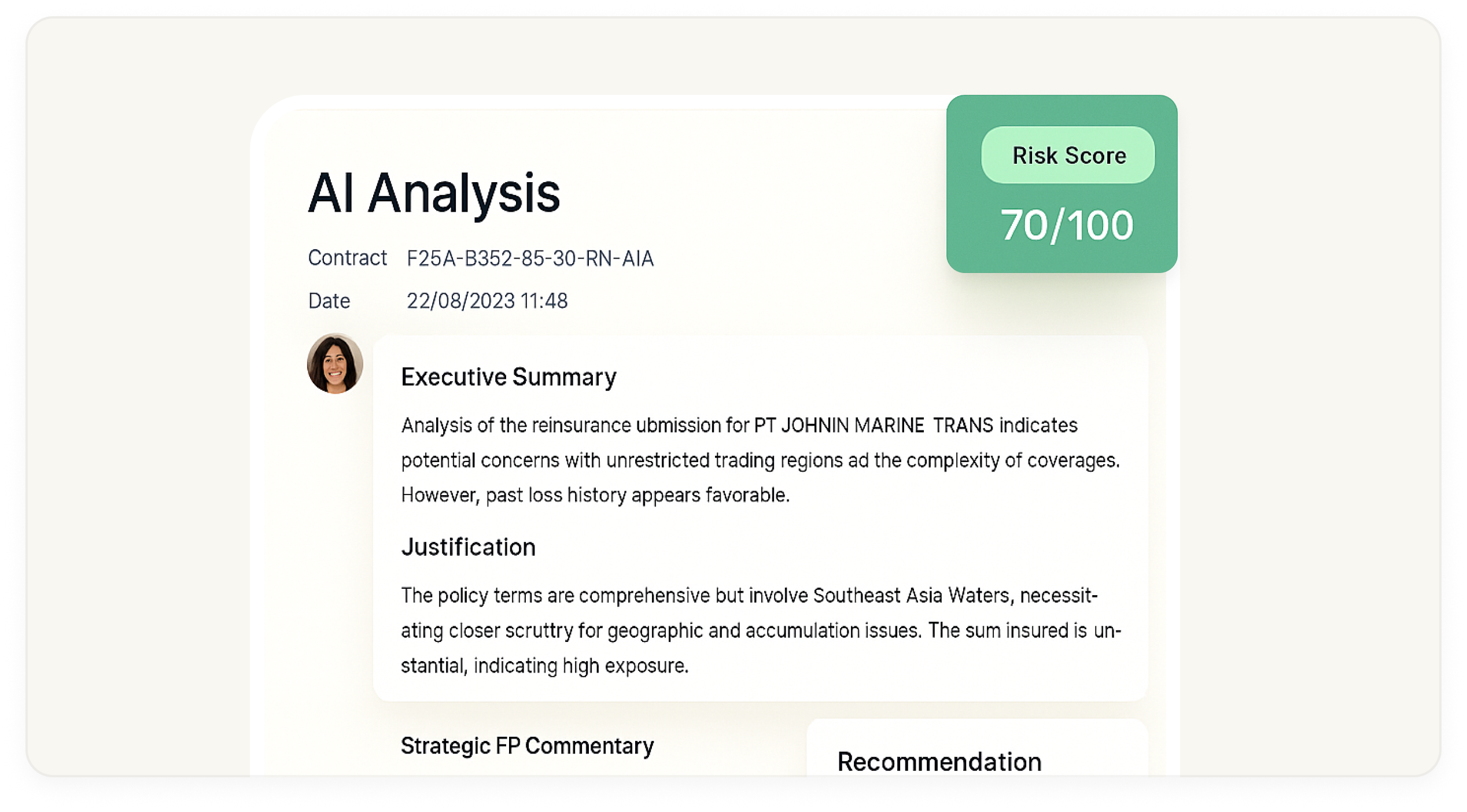

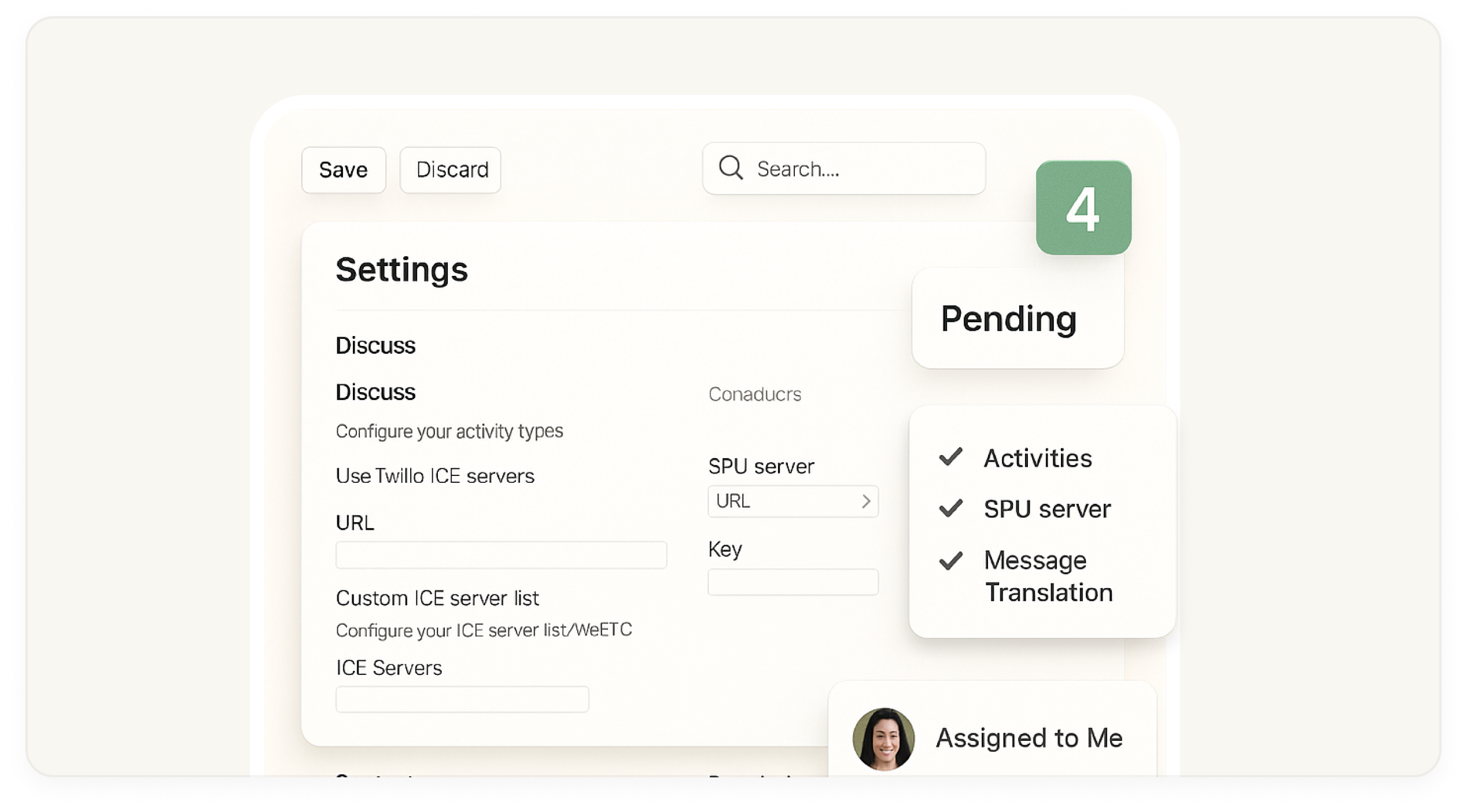

Smart Automation +

AIIntelligent workflows supported by AI. Designed to reduce manual work, accelerate processes, and empower teams.

-

Seamless

by DesignAPI-first integration that works on top of your existing systems,

no rip-and-replace, no disruption. -

Transparency

& ControlFull visibility across operations, including pre-submission tracking,

the critical stage 90% of businesses don’t see.

Plus, compliance alignment and real-time oversight.

What’s Inside Manit Labs

-

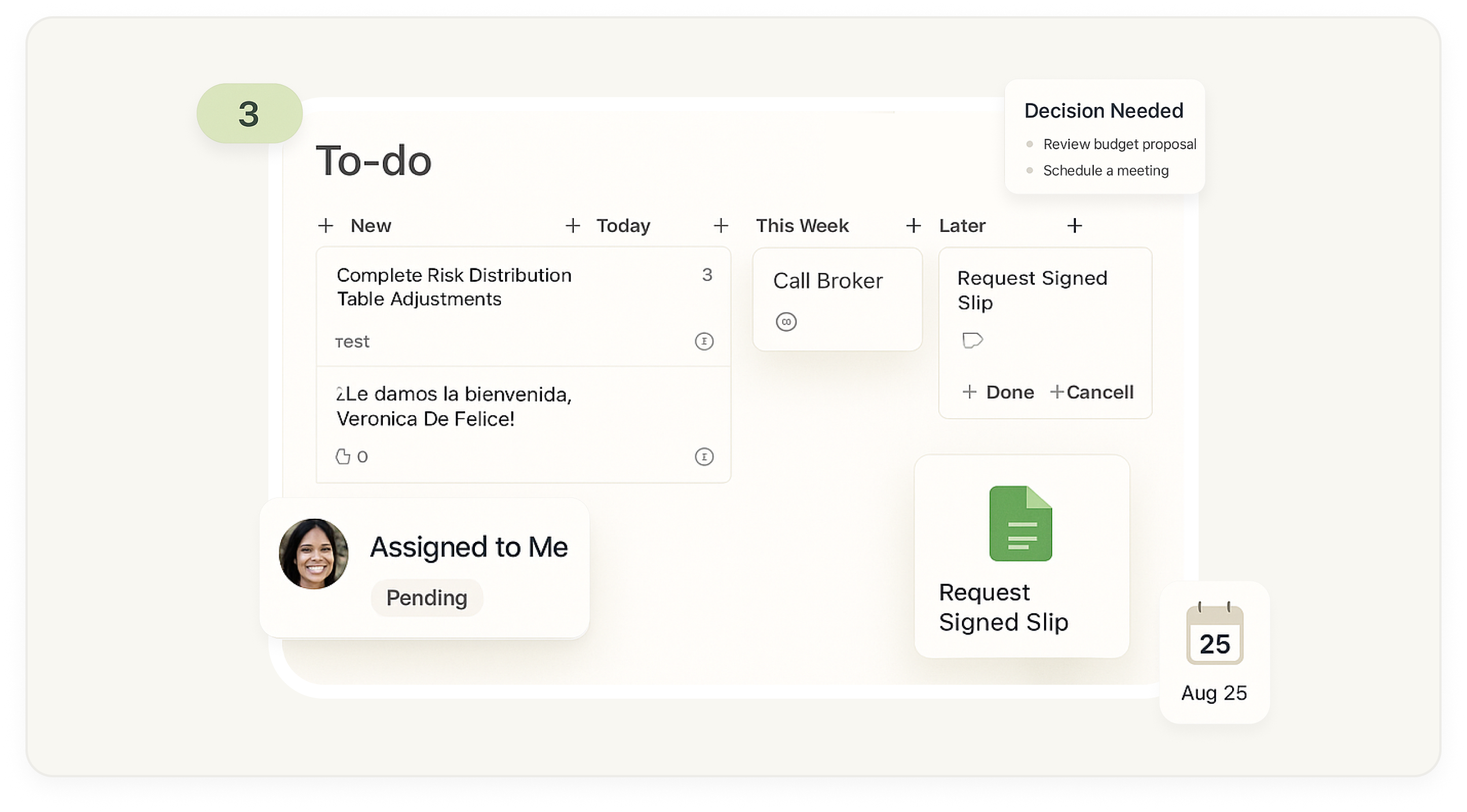

AI-Driven Underwriting & Claims

Automate data collection, risk scoring, fraud detection, and triage — all in one module.

-

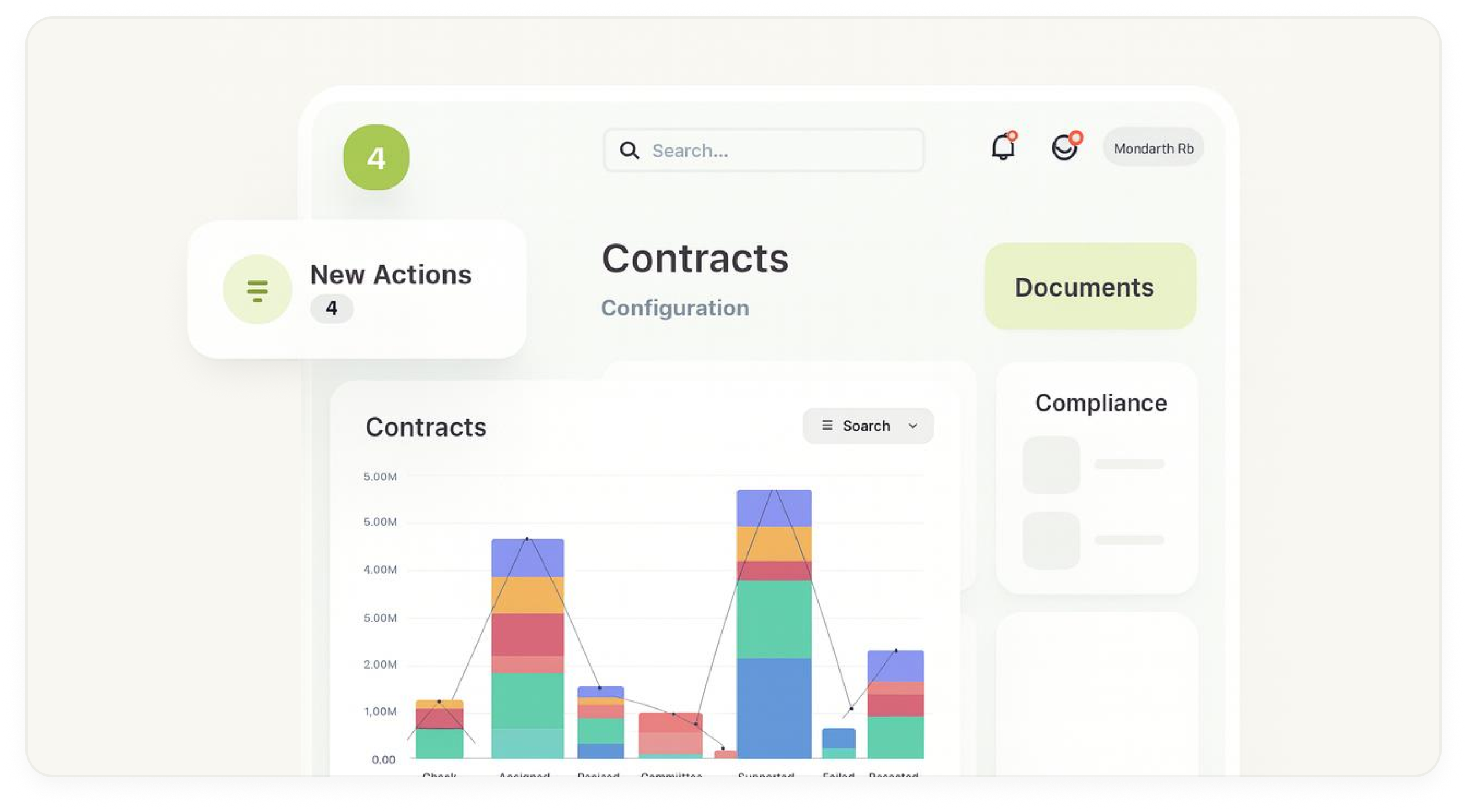

Unified Dashboard

A single workspace with live updates for underwriting,

claims, and finance teams.

Request a Demo

-

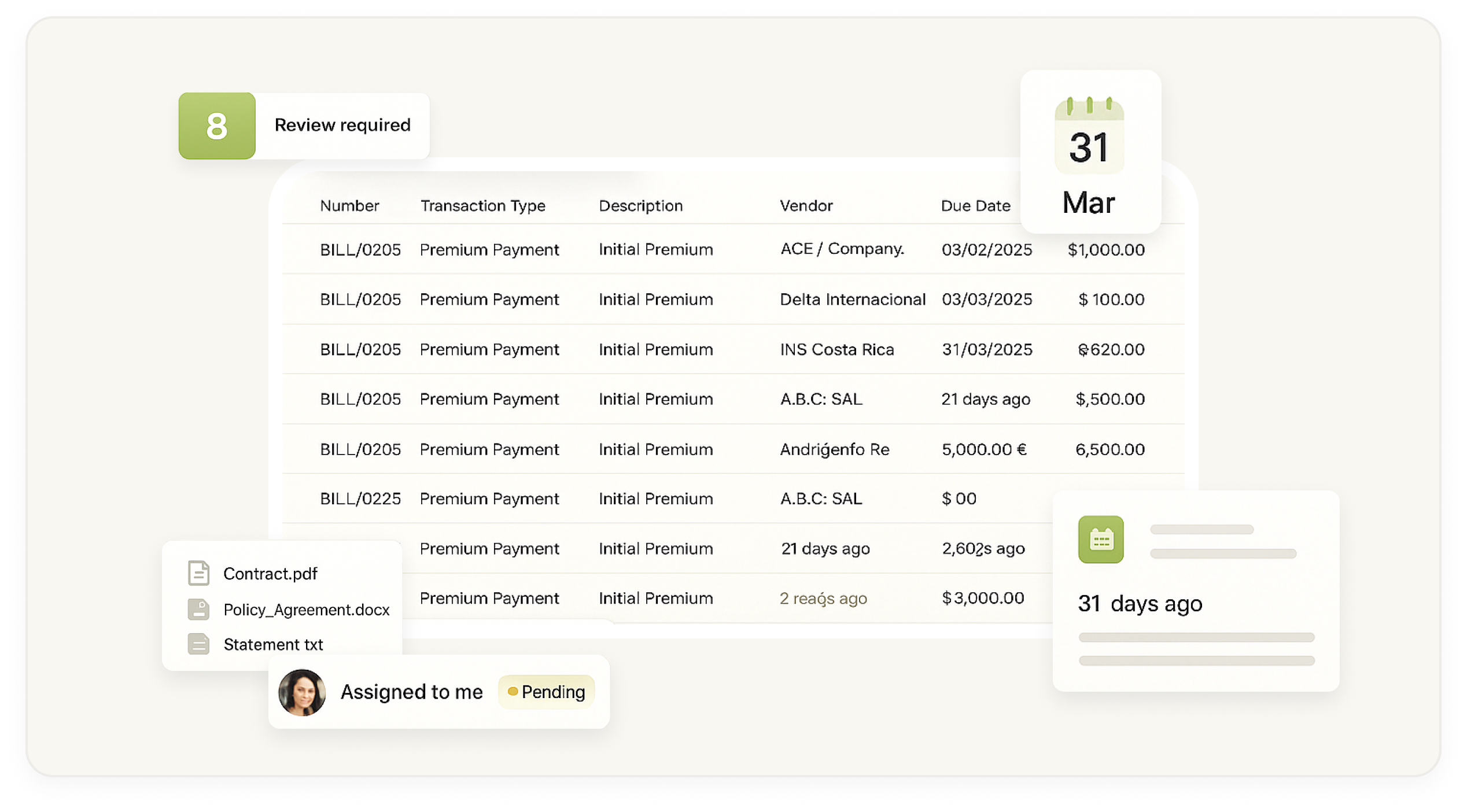

Finance & Analytics

Real-time dashboards, KPI tracking, and automated reporting to keep performance on track.

-

Smart Workflow Orchestration

Coordinate tasks across teams and systems

with automated handoffs and process triggers.

-

Seamless Integrations & Open APIs

Easily connect your existing systems — policy, billing, CRM, and more.

-

Security & Compliance

Enterprise-grade data protection and built-in industry compliance.

-

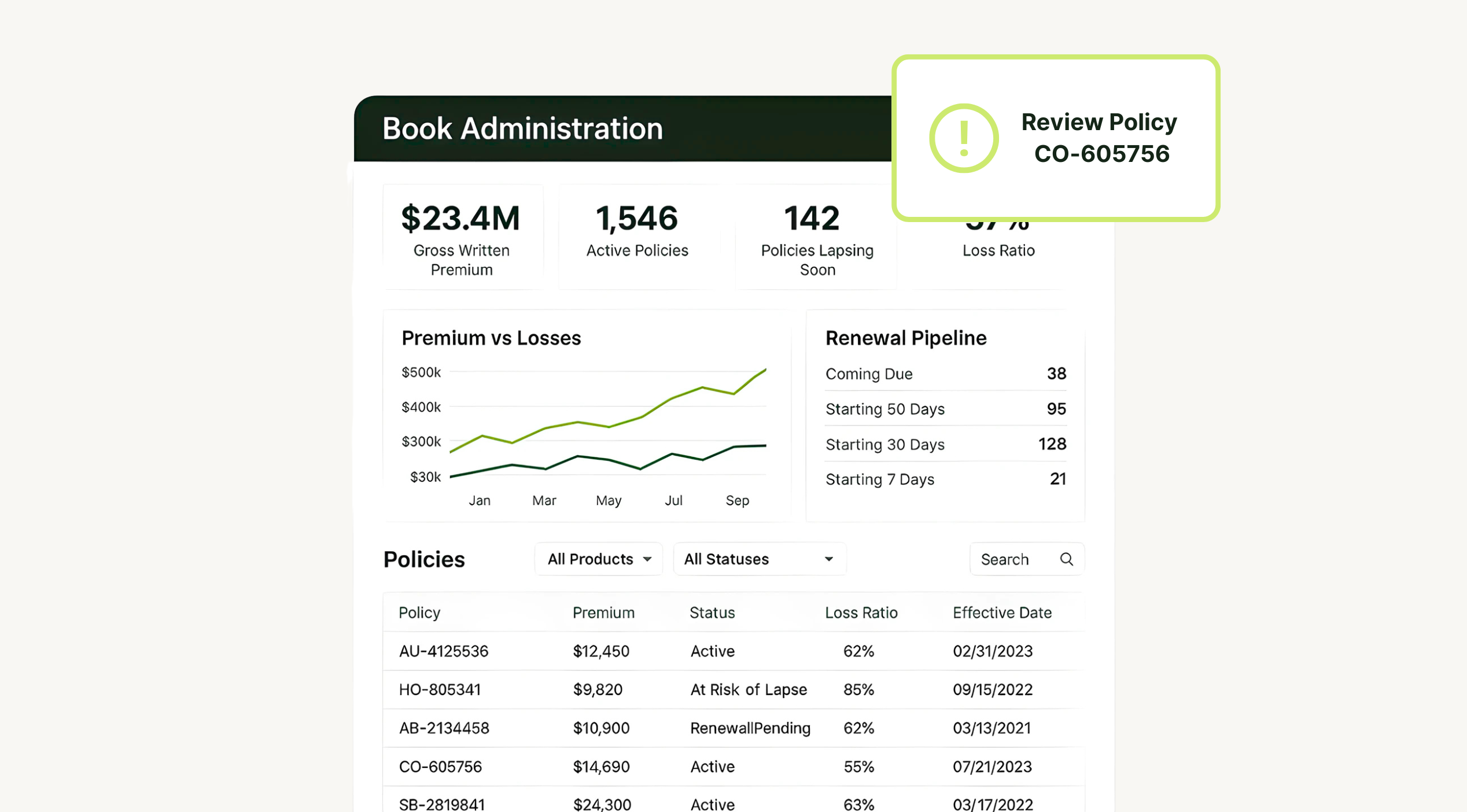

Book Administration

Unify your portfolio in one connected workspace, so every policy, premium, and renewal is visible, trackable, and actionable.

Built for Every

(Re)Insurance Model

-

Carriers

Simplify underwriting, cut manual work,

and accelerate claims resolution. -

Reinsurers

Unify global portfolios

with real-time visibility and stronger control. -

MGAs & Brokers

Automate submissions, deliver faster service, and scale profitably.

Why Manit Labs?

-

We Simplify Operations

Turn manual processes into automated workflows: faster, more accurate, more efficient.

-

We Give You Full Visibility

See every step in real time, from pre-submission leads (missed by 90% of businesses) to final claims resolution.

-

We Ensure a Secure, Seamless Fit

Integrates securely with your existing systems, no rip-and-replace, no downtime.

-

We Drive Measurable Results

10 days to pilot, 60% less manual work, up to x2 revenue growth.

What our clients say

Related articles

Active Certifications:

We align with globally recognized standards to keep your operations and data secure.

-

SOC 1 Type I & II

-

SOC 2 Type I & II

-

CSA CAIQ v3

Ready to rethink your

(Re)Insurance operations?

Let’s talk about how ManitLabs can simplify your workflows

and drive performance